Influence Sales, Elevate Income, and Amplify Impact

Helping You Grow and Scale a Wildly Successful Business Online...To UnCage Your Voice, Your Knowledge...

Influence Sales, Elevate Income , and Amplify Impact

Helping You Grow and Scale a Wildly Successful Business Online...To UnCage Your Voice, Your Knowledge...

Helping You Grow and Scale a Wildly Successful Business Online...To UnCage Your Voice, Your Knowledge...

GET ON HEATHER’S VIP LIST

for exclusive business + leadership insights and first notice on upcoming events.

Listen to UnCaged with Heather Havenwood

Get great advice from the guru directly on Heather's weekly podcast

You Are The Expert in Your Life | James Miller

9th June 2022

• The UnCaged™ Entrepreneur Heather Havenwood • Heather Havenwood | Haven Media Network

Clubhouse Visibility Profit Strategies with Heather Havenwood

14th January 2021

• The UnCaged™ Entrepreneur Heather Havenwood • Heather Havenwood | Haven Media Network

Meet Heather Ann Havenwood

Heather Ann Havenwood, CEO of Havenwood Worldwide, LLC and Chief Sexy Boss, is a serial entrepreneur and is regarded as a top authority on internet marketing, business strategies and marketing.

Since marketing her first online business in 1999, bringing together clients and personal coaches, she has played an active role in the online marketing world since before most even had a home computer.

In 2006 she started, developed and grew an online information marketing publishing company from ground zero to over million in sales in less than 12 months. Starting without a list, a product, a name or an offer, Heather Ann molded her client into a successful guru now known as an expert in his field.

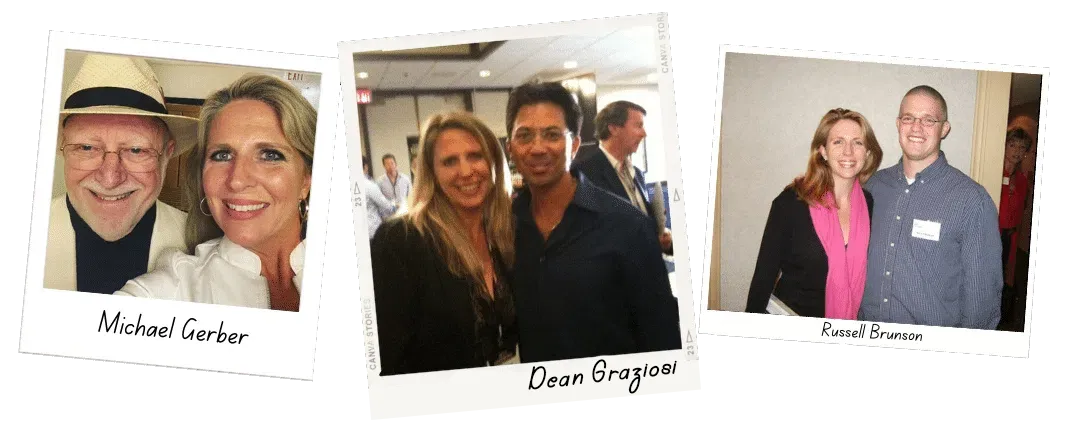

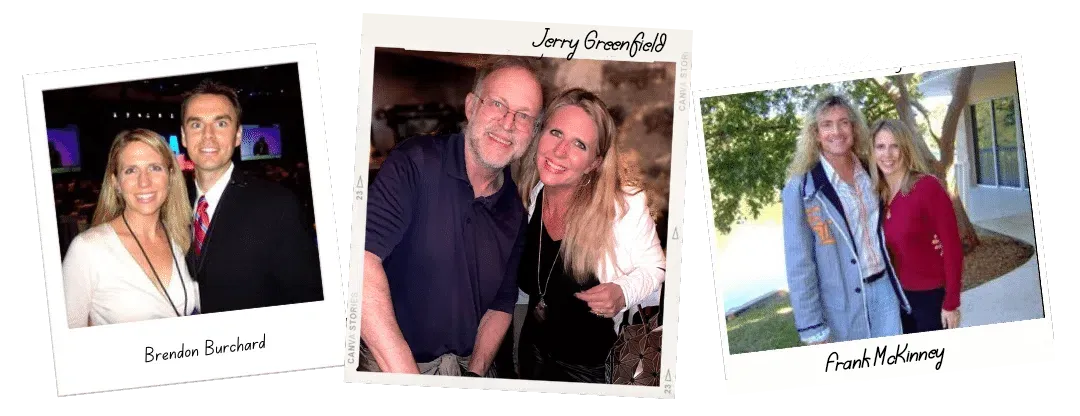

Heather ann & celebrities 😎

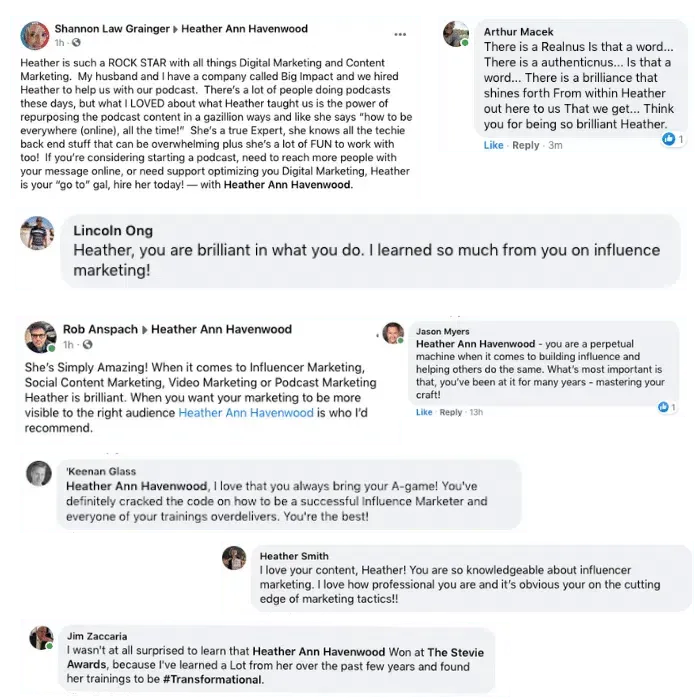

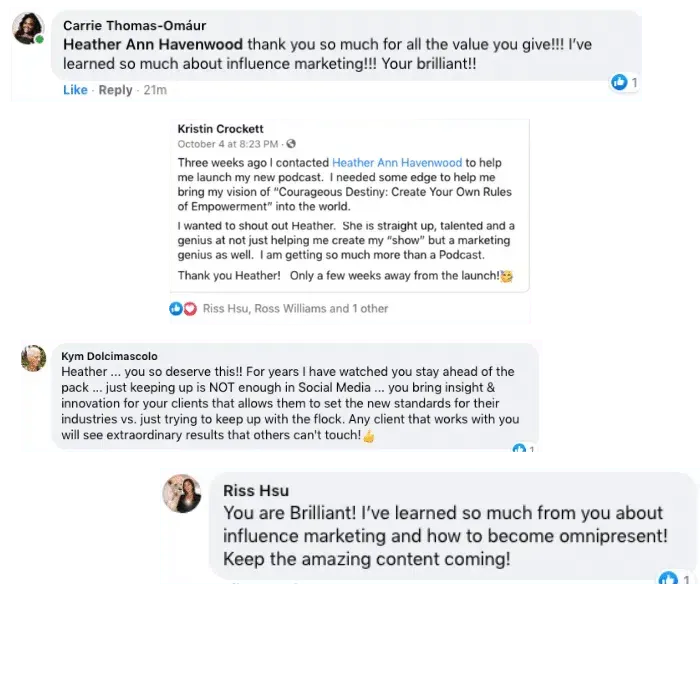

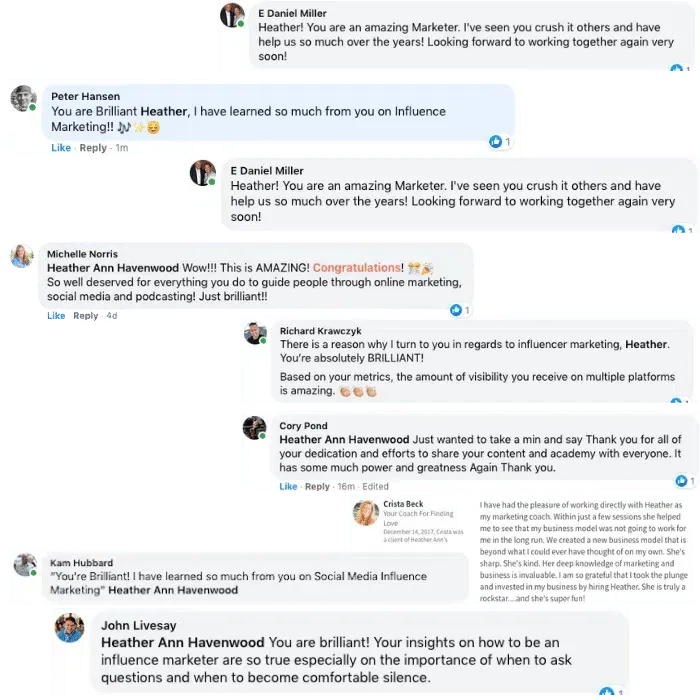

What Others Say About Heather Ann Havenwood...

Heather has touched many people across multiple spectrums...see what they are saying

Working with Heather Havenwood

Now you too can work with Heather Havenwood and get coaching from the best

Dear Friend and fellow Entrepreneur,

I’m currently looking for just a small handful of “dream” clients that I can personally coach and help bring in massive windfalls for, starting RIGHT NOW.

If you’re the kind of passionate, committed, entrepreneurial client I’m looking for,

I will personally work with you one-on- one in your business to help you double, triple, or maybe even quadruple your revenue for the next 12 months.

Here’s the deal:

I’ve just cleared out a of handful spots in my calendar to personally work with a few serious entrepreneurs who want to take their business to the next level.

And if you qualify, I’m going to offer you a 100% FREE consultation and strategy session with me by phone or Skype.

There is NO charge for this and there’s NO catch.

If you enjoy the conversation and get value from it, we can discuss working together long term.

And if you feel I’ve wasted your time in our conversation, I’ll even send you a check for $150.00 as compensation.

Either way, you come out ahead.

Peek into into Heather's

life & "happy place",

APPROVED Books:

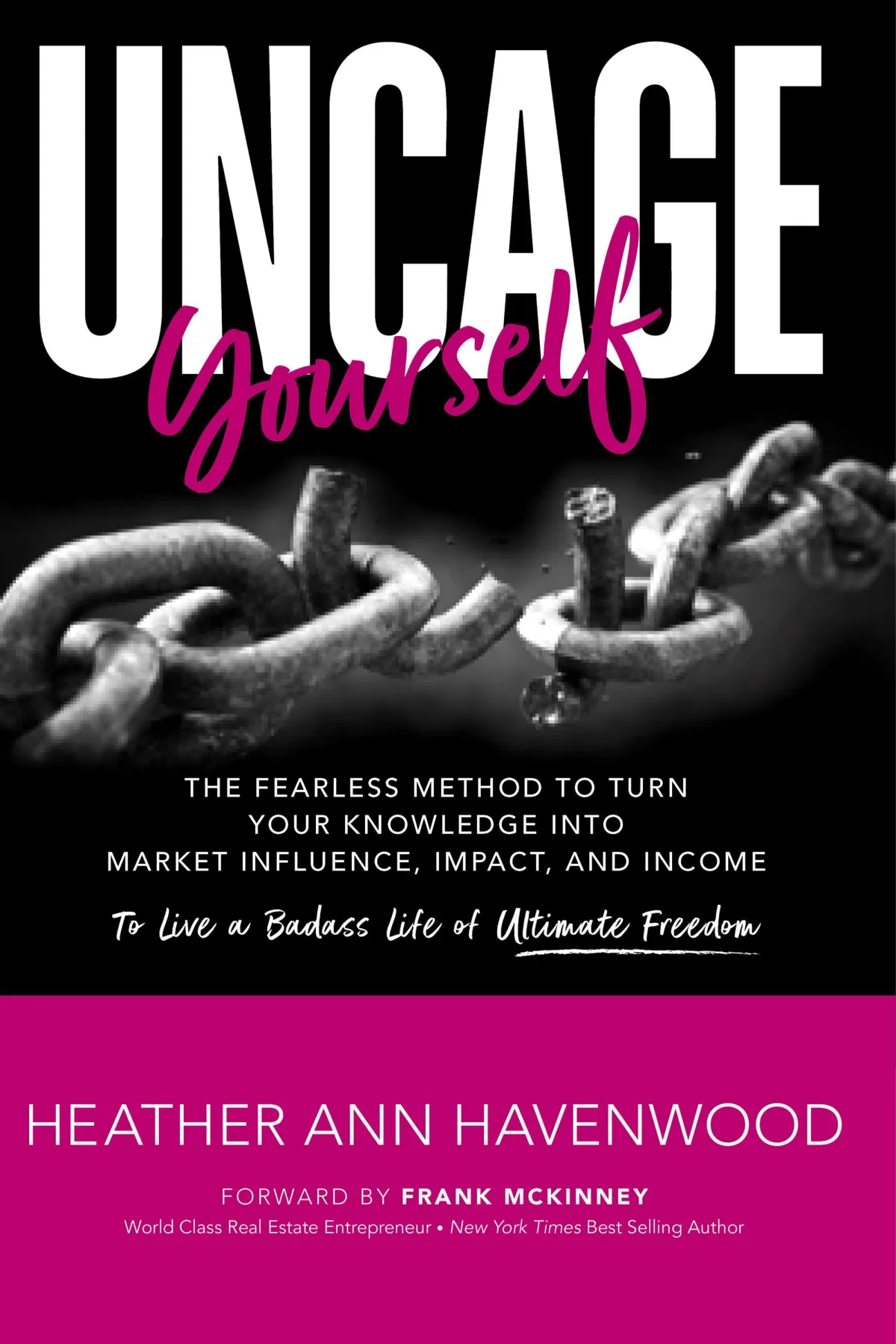

UnCage Yourself

Published 2023

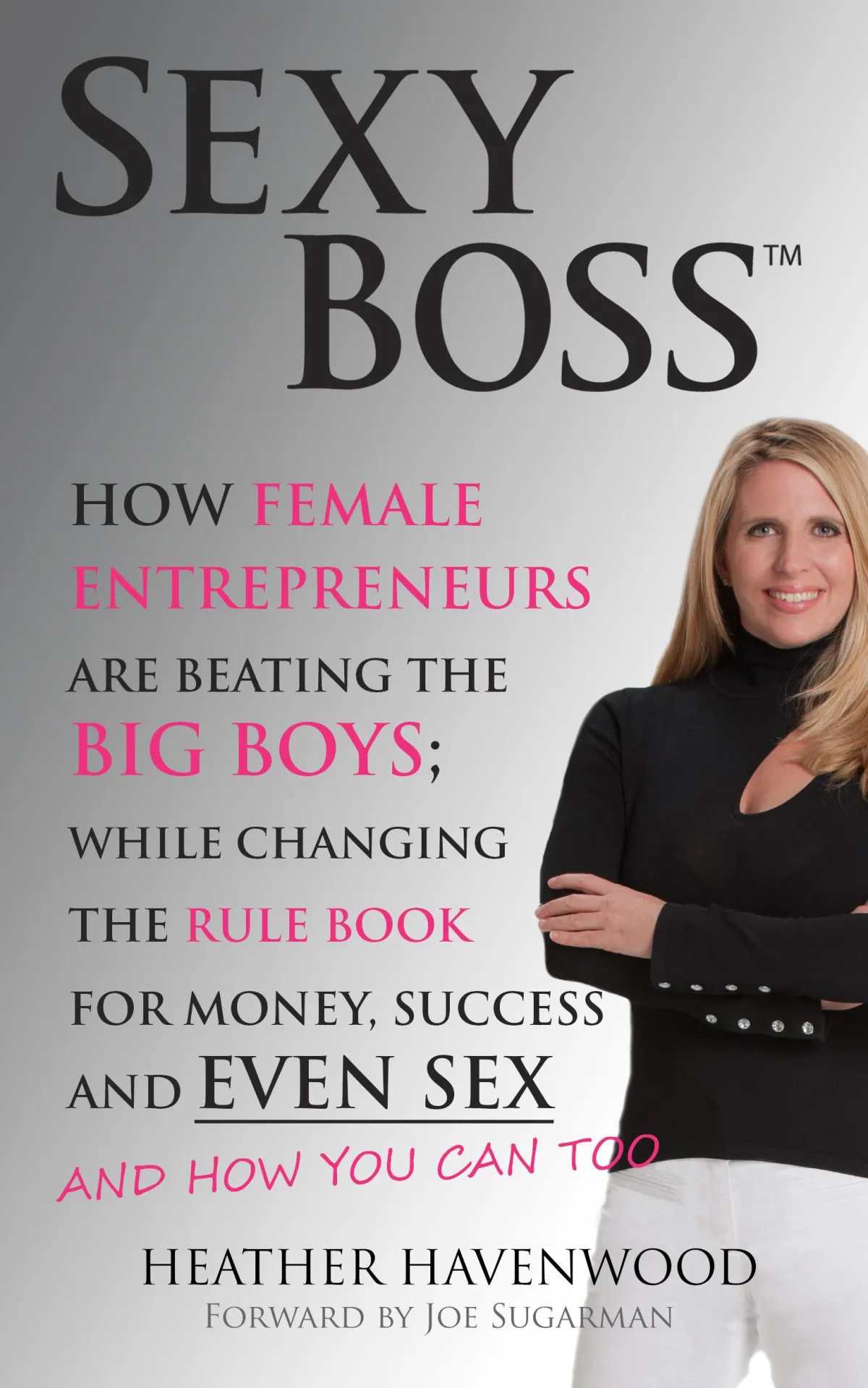

Sexy Boss

Published 2012

Podcast Guesting

Published 2017

Heather's Awards

Top Female Social Media Award - 2020

Heather Havenwood Ms. Elite Texas - Woman of Achievement 2020

Sexy Boss Book

#1 Amazon Best

Seller - 2017

What People Are Saying About Heather

Heather has touched many people across multiple spectrums...see what they are saying

Heather Ann truly knows how to use her mind, femininity and wit to win people over and make things happen, she teaches every woman how to confidently be a great in business!

Lauryn Weiss

I adore Heather’s take on business because it comes from a firehose of powerful confidence. Blast me with all you have, girl! I love what you do and so does everyone else. Blast on.

Susan Bratton

Women have leveled the playing field when it comes to entrepreneurship and running a business. The techniques expressed are valuable to both men and women.

Facebook

Instagram

Youtube

TikTok

LinkedIn